BitClout: dissecting the ultimate FOMO machine

Centralization, inflated token prices and other red flags

If you're even remotely into crypto you will have heard about BitClout by now. If not, I guess it could be described as a Twitter meets Blockchain: It's a social network with very similar features to Twitter, with the twist that you can buy and sell "creator coins" from your favorite people. I spent some playing with BitClout recently and I am very ambivalent about the platform: on one hand I love it's (theoretically) decentralized and pseudo-anonymous take on Social Networks, but on the other hand I am full of questions.

I really like BitClout's concept on paper: you can not only express your support towards someone with likes and following them, but you can also participate on their success and have skin in the game by buying their creator coin, which will supposedly increase in value when and if that person's clout gets bigger.

In order to buy creator coins you first need to buy BitClout ($BTCLT) tokens by funding your wallet with Bitcoin.

Its (in theory) decentralized nature (more on this below), should make the network censorship-resistant and it also allows yourself to sign up pseudo-anonymously, by funding your account with Bitcoin for improved anonymity. Those two things are huge wins compared to Twitter for any privacy-minded person like myself.

However let's start asking the tough questions. How decentralized is it really, though? How are BitClout tokens created? What is their supply curve? How are their price determined? Well, here is where it gets really murky, as BitClout is very opaque for a blockchain project: Its "One Pager" (who needs a whole White Paper when a simple one-pager gets all VCs lining up to throw their money in it?) seems written in 20 minutes and honestly it's probably more useful as toilet paper than as a technical document.

What follows is me trying to answer critical questions any serious investor should ask themselves before putting any money in BitClout. I put some skin in the game myself by buying around ~$2K of $BTCLT and playing around in the platform to understand it better. These are my thoughts.

Opacity and Centralization

BitClout says in their One Pager:

Just like Bitcoin, anyone on the internet can run a BitClout “node” (sic) that serves the BitClout content, and every node on the network stores a full copy of all the data. This means that anybody can build apps on top of the BitClout data without the risk of being de-platformed, and they can even create their own feed algorithm.

When you visit bitclout.com, you’re using our node, but there are already dozens of nodes on the network, all run by people like you.

There's a lot to unpack here. First, I don't know what is more worrying, the fact that the author of the document used quotes incorrectly to highlight the word node, or that they used them correctly to mean that actually, it's not really a node, node. I can't really tell you which one is it because despite my best efforts, I have not been able to find BitClout's "node" implementation -- I don't think anyone has seen it, actually. This is the first and huge red flag. I've never seen any "decentralized" project that does not publish their source code for other to analyze, even proven scams like Bitconnect had some sort of source code, if only for appearance.

Ok, let's continue unpacking:

When you visit bitclout.com, you’re using our node, but there are already dozens of nodes on the network, all run by people like you.

Of course, I could not find any proof as that being the case. As far as I've seen, when you use BitClout you are always interacting with the same domain, without any kind of decentralization layer like IPFS or similar in-between. They actually admit that bitclout.com is a node controlled by them (the creators), and I've been unable to find any other BitClout node, operational or under development by any other team of developers, which points to a totally centralized architecture, at least for now.

More proof that BitClout is totally centralized is the fact that its creators have been implementing changes to the system without any kind of consensus mechanism or voting. I guess the devil's advocate argument could be that the system is still in its infancy, so its creators might still be iterating on some features before they open up the protocol to other nodes and change becomes exponentially more difficult. Ok, I could buy that, but if that is the case, why not openly admit to it? "Hey, this is not really decentralized yet yet, but we're working on it". Why would we blindly trust a faceless team of people who are not being transparent with our Bitcoins? True crypto projects are founded on being trust-less: participants don't need to trust any third party as the source code is publicly available and enforced by an heterogeneous set of node operators, all driven by their own self-interest. This is definitely not the case here as there is a huge information asymmetry between BitClout's operators and the network participants, forcing the participants to blindly trust the operators.

Furthering my point about BitClout's opacity, its creator famously told Coindesk that "BitClout is not a company. It is a proof-of-work blockchain designed for running social media. It was created by an anonymous group of developers."

Hmm, sure. But if that is the case, where does the personal data users are providing -- their phone numbers for some free $BTCLT, and their email addresses -- going? I checked in their blockchain explorer and that data is, thankfully, not there. Where is it then? It really looks like it's in a centralized server somewhere controlled, again, by BitClout's operators. This raises serious privacy concerns: if our data is not under a company's control, where is it?

BitClout's Token Pricing

Let's say you don't care about decentralization and transparency, and you only want to hustle in the platform and make money. I respect that. The bad news is that BitClout's economics are, IMO, quite shady. Disclaimer: What do I know anyways? I am just a rando on the internet, so take what I say next with a pinch of salt.

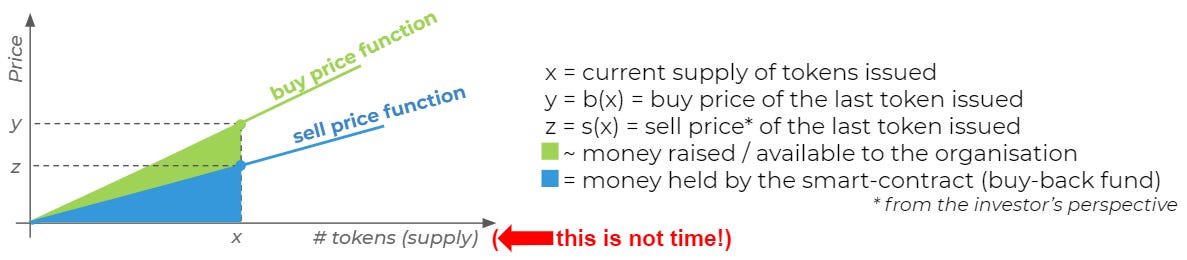

Unlike other cryptocurrency projects, BitClout is not doing an ICO. Instead, judging by the article they link on their One Pager, it seems that they are cherry-picking features from Automated Market Makers and from Continuous Organizations without being neither. They hint at it on their document by hand-wavingly describing their token's pricing function:

The price of BitClout doubles for every million BitClout sold. This makes BitClout naturally scarce, resulting in 10 to 19 million BitClout minted in the long run (less than Bitcoin’s max supply of 21 million).

According to what I just learned about Bonding Curve models, that is exactly how a Bonding Curve for an Automated Market Maker would work: instead of defining the issuance of tokes over time, there is no cap on the number of tokens in circulation, and they define the token's price over number of tokens issued. The more tokens, the more expensive they become, which, in a rational world, should curb the demand for those tokens, effectively also capping its supply at some point (not because there are no more tokens minted, but because no one is willing to buy more at that price). A doubling of the price is describing an exponential Bonding Curve, which taking an arbitrary initial price of $100, results in this price chart:

The big catch is that regular Continuous Organizations models allow their users to sell their tokens for "reserve tokens" (Bitcoin) while the organization takes the buy-sell spread. But not in the case of BitClout: right now there is now way in hell to sell, creating exactly 0 incentives for BitClout's operators to behave ethically, as BitClout's users hold absolutely no sway over the operators available funds: they already got our Bitcoins and, unless they voluntarily implement the sell feature (again, this implies we have to trust them to be honest and ethical), our Bitcoins are gone while they dumped their $BTCLT on us.

☝️ This is how a normal Continuous Organization is supposed to work: they take the buy/sell spread from users trading their token to fund their project. Not how BitClout works. Remove the "sell price function" from the above graphic (as no one can sell $BTCLT), and the whole area below the "buy price function" line is pure profit (i.e. our Bitcoins in BitClout operators’ wallet).

Allowing you to sell would mean that either BitClout's operators would have to give back some of the Bitcoin — which I don't think they want to do —, or they would have to setup some kind of exchange where other market participants could trade their tokens without going through them, which as explained below would probably tank $BTCLT price as soon as price discovery is allowed to happen.

Let's try to figure out some reasonable estimate of where the price should be, forgetting about fancy "Bonding Curve" models. Using the tried-and-true Book Value method, we have that the theoretical float of BitClout should be:

BTC address balance: $256,052,057.17 (4155.99972168 BTC)

Current $BTCL price: $174.60 (set by BitClout, as 2021-04-16)

Theoretical Float: 1,466,506 tokens (if all tokens had been mined at the same price)

Of course, that does not make any sense as we know that, at least, there are more than 2M $BTCL tokens out there from the pre-mine and that tokes have been mined at different price points. This leads me to believe that if $BTCLT was freely trading in an exchange and the token's float information was publicly available, it would be trading much lower than the current set price of $174.60. Let's run the numbers, assuming a conservative float of 6M tokens (where the pre-mine would have been for 1/3 of the total supply):

BTC address balance: $256,052,057.17 (4155.99972168 BTC)

Assumed float: 6,000,000

$BTCL price: $42.68 (or 75% lower than its current price)

Actually, I was not that far off! Just after writing this part of the article, I found WithdrawBitclout, a third party service where users can sell their BitClout tokens and get out of their ruinous investments. Here are the prices BitClout is actually selling for: between $39-$91 depending on volume, a mere 77% to 47% discountn on the buy price. Talk about wide spreads!

Not only that, but a little bird told me that BitClout's strategy to attract VC money is to offer them BitClout tokens at 25% off. It's brilliant, honestly: they managed to FOMO some of the top VCs into throwing their money at this un-sellable, infinite-supply token while they are raking in stacks of Bitcoins. Bravo. Apparently the VCs strategy is to "exit" when BitClout enables sales of $BTCLT token, good luck with that.

The FOMO-nomics continue with Creator Coins

But of course BitClout hasn't only FOMO-ed VCs into investing in the platform, but the whole platform is based on FOMO. One could say that BitClout effectively invented FOMO-nomics: they used exponential pricing curves for both the BitClout token, and the Creator Coins curves, which means that the earlier you get in, the more upside you have. Of course this is only the case because the token price is controlled algorithmically in the platform, but as we saw above would probably not stand the test of the token being freely traded.

It's clear that they want everyone to know that gains are potentially exponential as the only detailed section of the One Pager doc is the section where they describe the pricing curve of the Creator Coins:

The formula or “curve” for determining the price of a creator’s coin is as follows. Note that creator coins are normally bought and sold with the BitClout cryptocurrency, but we provide a dollar version of the formula for easy calculating:

Price in BitClout = .003 * creator_coins_in_circulation^2

Price in USD = .003 * creator_coins_in_circulation^2 * bitclout_price_in_usd

Which, again, yields the familiar exponential price curve:

This has lead to users buying a few cents of new users' tokens in the platform, which is basically akin to playing the lottery: if that user turns out to become huge in the platform, those cents will turn into hundreds or thousands of dollars. There are even tools, like this Telegram channel, that broadcast new user signups in the platform so other people can buy their tokens "at floor level", before they exponentially take off.

Again, hats off to them for coming up with an algorithmically-driven FOMO generation machine. The way the platform is setup will definitely attract people in search for a quick buck, but I am not sure these pricing curves will be conducive to the long-term sustainability of the platform, or to a thriving social network.

Well, I guess if the model stops working after a while the operators can just make some changes in the code, deploy them, and, voilà! The economics of the platform and all the assumptions and behaviors built on to them can change overnight because this is, repeat with me, not a decentralized cryptocurrency project!

Red Flag Recap

🚩 BitClout is not decentralized

🚩 BitClout is not transparent (no source code, very poor quality "One Pager")

🚩 BitClout did a pre-mine of unclear proportions

🚩 BitClout collects PII from users and it's unclear for what purpose and where it's stored

🚩 BitClout's token has no supply cap and its price is inflated as, for now, users can only buy but not sell it

🚩 BitClout's Creator Tokens encourages FOMO, but unclear if it's sustainable once the hype dies out

My take

I think right now it's impossible to know if BitClout is just a badly-ran legit and potentially revolutionary crypto project, or its operators are knowingly running some kind of malicious scam.

I think the range of possible realities spans between the most charitable interpretation where BitClout is a legit project and its operators are temporarily retaining the control of the project until its mature enough to be a truly decentralized and transparent project; and the worst case scenario of BitClout's operators holding almost 100% of the $BTCLT supply and selling it at artificially inflated prices to unsuspecting people by inducing FOMO with the only goal of enriching themselves.

I think there are plenty of red flags to go around, so even if only some of them turn out to be an actual concern at the end of the day, it'd be pretty bad already. What makes me the most suspicious is that most of those concerns could be done away with by simply releasing the source code of the project, or with an actual technical white paper. Lack of both of those artifacts points to some shady shit going on IMO.

What's your take? Let me know in the comments below or let me know @Redbeard, of course, on BitClout.

- Redbeard 🏴☠️